| Event | Market impact |

|---|---|

| EDF meeting | 2-3% increase on Bitcoin |

| Lecture by Jérôme Powell | Progressive resumption of the market |

| Capitulation of new investors | Sign of consolidation before a new growth phase |

URGENT – The EDF pushes the market: these indicators announce the continuation of the bullrun!

The EDF meeting had a significant impact on the cryptocurrency market, and technical indicators suggest a continuation of the bullrun. Yesterday, the EDF maintained its rates between 425 and 450 basis points, which was seen as a positive decision by investors. This decision was followed by an immediate market reaction, with a 2-3% increase on Bitcoin and an awakening of some Altcoins. Jérôme Powell’s conference also brought positive elements, particularly as regards the ability of banks to respond to their customers’ cryptographic requests.

Market volatility was marked by an initial correction followed by a gradual increase. Between the decision of the EDF and the conference of Jérôme Powell, the market experienced a correction, probably due to unmet expectations regarding a fall in rates. However, the conference reassured investors, leading to a gradual recovery of the market. On-chain indicators show that new investors have capitulated, which is often a sign of consolidation before a new phase of growth.

The next few weeks will be exciting, with a confluence of technical and economic factors. The current trend suggests that there may be significant market movements by February 9. Investors must remain vigilant and adjust their strategies accordingly.

Impact of the EDF meeting on the market

The EDF meeting was a key event for the cryptocurrency market. By maintaining its rates between 425 and 450 basis points, the EDF sent a signal of economic stability. This decision was welcomed by investors, resulting in an immediate increase in Bitcoin and some altcoins. Jérôme Powell’s conference also brought positive elements, particularly as regards the ability of banks to respond to their customers’ cryptographic requests. However, Powell recalled that crypto remains a risky domain, which tempered the enthusiasm of investors.

Volatility and market reaction

The market experienced significant volatility after the EDF meeting. Between the decision to maintain the rates and the conference of Jérôme Powell, the market underwent a correction, probably due to unsatisfied expectations regarding a fall in rates. However, the conference reassured investors, leading to a gradual recovery of the market. On-chain indicators show that new investors have capitulated, which is often a sign of consolidation before a new phase of growth.

Prospects for the coming weeks

The next few weeks will be exciting, with a confluence of technical and economic factors. The current trend suggests that there may be significant market movements by February 9. Investors must remain vigilant and adjust their strategies accordingly. Technical indicators show a confluence between current trends and levels of support and resistance, which could lead to violent market movements.

| Event | Market impact |

|---|---|

| EDF meeting | 2-3% increase on Bitcoin |

| Lecture by Jérôme Powell | Progressive resumption of the market |

| Capitulation of new investors | Sign of consolidation before a new growth phase |

Bitcoin Market Analysis: Capitulation Phase and Key Indicators

The Bitcoin market is currently going through a capitulation phase a situation we have not seen since 2021. Despite this, Bitcoin remains above $100,000, raising questions about impatience and investor expectations. The recent movements of Bitcoin, ranging from $90,000 to $109,000, do not seem to be volatile enough to satisfy those who hope for a rapid rise to the north.

This capitulation phase is also visible through several on-chain indicators. For example, supply short term holders (short-term holders) is re-increasing, a phenomenon similar to what we have seen in previous halving cycles. This trend suggests that short-term investors are increasingly present in the market, which may indicate preparation for a new uphill phase.

Another crucial indicator is the Estimated Leverage Ratio (ELR), which measures appetite for investor risk. This indicator increased sharply during the Bull Run of 2021, showing increased investor confidence. However, this also increased liquidations in the 2022 declines. It is therefore essential to note that increasing leverage can lead to excessive excitement in the market, which can be dangerous for less experienced investors.

Capitulation Phase and Recent Movements

The current capitulation phase is a rare situation, especially since 2021. Investors seem impatient, hoping for fast and meaningful performance. However, recent Bitcoin movements, ranging from $90,000 to $109,000, do not meet these expectations. This stagnation could be due to a lack of market knowledge or the inexperience of new investors.

On-Chain Indicators: Short Term Holders Supply

The supply short term holders is a key indicator for understanding market movements. Currently, this supply is increasing again, a phenomenon similar to what we have seen in previous halving cycles. This suggests that short-term investors are increasingly present on the market, which may indicate preparation for a new uphill phase.

Estimated Leverage Ratio (ELR): Appetite for Risk

The Estimated Leverage Ratio (ELR) is another crucial indicator. It measures appetite for investor risk and increased sharply during the Bull Run of 2021. However, this increase in leverage also amplified liquidations during the declines of 2022. It is therefore essential to note that increasing leverage can lead to excessive excitement in the market, which can be dangerous for less experienced investors.

| Indicator | Description | Impact on the market |

|---|---|---|

| Capitulation phase | Rare since 2021 | Investor impatience |

| Short Term Holders Supply | Similar increase to previous halving cycles | Preparation for a new uphill phase |

| Estimated Leverage Ratio (ELR) | Measuring appetite for risk | Amplification of liquidations in declines |

https://business-crypto.org/wp-content/uploads/2025/01/Graphic-show-the-capitulation-phase-of.webp

URGENT – The EDF pushes the market: these indicators announce the continuation of the bullrun!

After a peak of enthusiasm, there is a reduction in risk in times of decline. In downward trends, LR generally declines, indicating a return to a more prudent investor posture and a transition to a more stable market. This dynamic is essential to understand the evolution of the market and anticipate the phases of euphoria. Currently, we are slowly entering this euphoria phase, which could trigger a desire to position ourselves on leverage effects.

The key role of RLE in market dynamics

The Exchange Liquidity Ratio (ELR) plays a crucial role in understanding market dynamics. By comparing recent transactions to the annual average, it identifies overheated or undervalued markets. Currently, we are at 1.22, below the highest of March 2024 which was at 4.1. This metric is a key indicator to anticipate market phases.

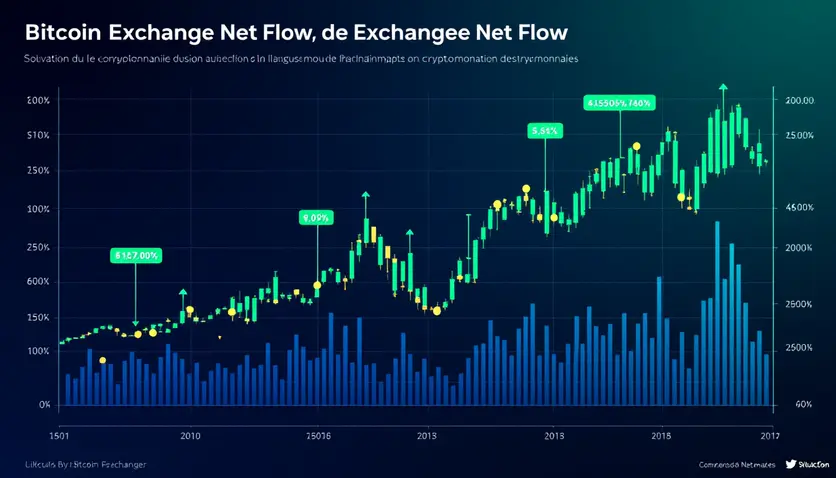

Bitcoin Exchange Net Flow: a bullish signal

Bitcoin Exchange Net Flow is another important indicator. BTC’s largest exit from the markets coincided with the low market in January 2023, confirming strong purchasing activity. This year, the maximum purchasing activity occurred around $100,000, despite a decrease in volume. Whales continue to accumulate, and with less and less bitcoin on exchangers, individuals could face difficulties in buying bitcoin at good prices.

| Indicator | Current value | Meaning |

|---|---|---|

| ELR | 1.22 | Accumulation market |

| Bitcoin Exchange Net Flow | Negative | Raising signal |

FAQ

What was the impact of the EDF meeting on the cryptocurrency market?

What was the impact of the EDF meeting on the cryptocurrency market?

The EDF meeting had a significant impact on the cryptocurrency market. By maintaining its rates between 425 and 450 basis points, the EDF sent a signal of economic stability, which was welcomed by investors. This led to an immediate increase of 2 to 3% on Bitcoin and an awakening of some altcoins.

Why did the market experience significant volatility after the EDF meeting?

Why did the market experience significant volatility after the EDF meeting?

The market experienced significant volatility after the EDF meeting due to an initial correction due to unmet expectations for lower rates. However, the conference by Jérôme Powell reassured investors, leading to a gradual recovery of the market.

What on-chain indicators show consolidation before a new growth phase?

What on-chain indicators show consolidation before a new growth phase?

On-chain indicators show that new investors have capitulated, which is often a sign of consolidation before a new phase of growth. The supply of short term holders is also increasing, a phenomenon similar to what we observed in previous halving cycles.

What is the role of Estimated Leverage Ratio (ELR) in market dynamics?

What is the role of Estimated Leverage Ratio (ELR) in market dynamics?

Estimated Leverage Ratio (ELR) measures appetite for investor risk. It increased sharply during the Bull Run of 2021, showing increased investor confidence. However, this also increased liquidations during the 2022 declines, which can be dangerous for less experienced investors.

What is Bitcoin Exchange Net Flow and what does it mean for the market?

What is Bitcoin Exchange Net Flow and what does it mean for the market?

Bitcoin Exchange Net Flow is an indicator that shows Bitcoin inputs and outputs on trade. A large net output, such as that observed in January 2023, often coincides with a strong purchasing activity and may be a bullish signal. Currently, whales continue to accumulate, which could make it difficult to buy bitcoin at good price for individuals.