| Indicator | Current status | Interpretation |

|---|---|---|

| Bitcoin Dominion | 57% | Bitcoin leads the market, typical in bull run |

| Altcoin ISR | In breathing phase | Indicates a break before a possible resumption |

| Crypto Fear and Greed Index | Under 90 | Not yet in euphoria phase |

| Bitcoin / Gold | Bitcoin surpasses physical gold, formation of a bullish model | Potential for higher prices |

| Open Interest | Achieved 67 billion, reporting high activity | Indicates increased volatility |

| Availability on trade | Historically low (ATL) | Probable increase in prices due to scarcity |

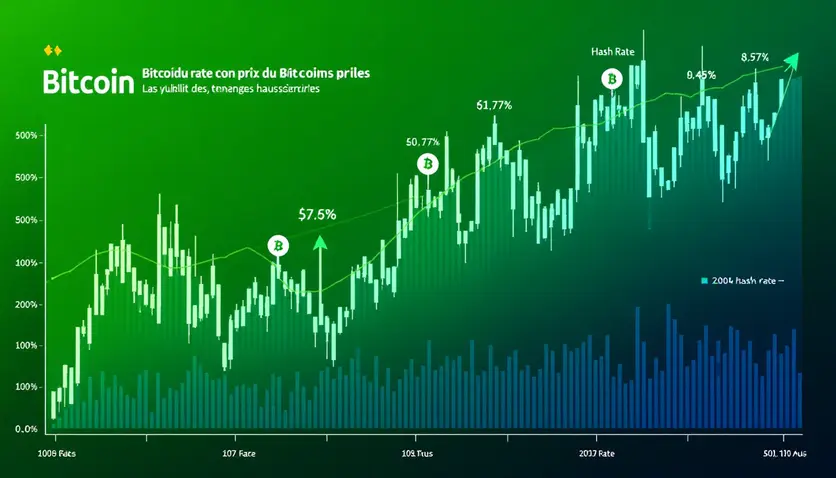

| Hash Rate | Power of calculation of miners in sharp increase | Trust of minors in the network |

| Crypto narratives | DeFi and Small Cap growing, AI still shy | Targeted investment opportunities |

Bitcoin: Key indicators for understanding the current market

The cryptocurrency market is booming, with a bitcoin that continues to beat records. In this analysis, we explore the essential indicators to understand whether we are in a period of « heat », at the end of a bull run, or at the beginning of a new « alt season ». How can we strategically position ourselves in this context? Here is a breakdown of current trends.

Bitcoin in mind: an uphill dynamic

Bitcoin displays impressive performance, reaching $107,194, with three consecutive green candles. Although the volume has decreased slightly, this does not affect the upward trend. This situation is typical of bull runs, where Bitcoin opens the way before the altcoins follow. Currently, altcoins stagnate, but this could announce an imminent « alt season », often observed at the end of the cycle. Native tokens such as BGB and CRO show signs of recovery, indicating a growing interest of new investors via centralized platforms.

Technical indicators: what do they say?

Indicators such as the RSI and the Crypto Fear and Greed Index play a crucial role in market analysis. The Altcoin RSI shows a breathing phase after reaching peaks, which is normal in a prolonged bull run. The Crypto Fear and Greed Index, still below 90, suggests that we are far from the extreme euphoria needed for an explosive « alt season ». These data indicate a period of relative calm, but potentially conducive to sustainable growth.

| Indicator | Current status | Interpretation |

|---|---|---|

| Bitcoin Dominion | 57% | Bitcoin leads the market, typical in bull run |

| Altcoin ISR | In breathing phase | Indicates a break before a possible resumption |

| Crypto Fear and Greed Index | Under 90 | Not yet in euphoria phase |

Analysis of key indicators of the Bitcoin market

The Bitcoin market is currently marked by significant bullish signals, supported by several technical and fundamental indicators. These factors allow us to anticipate a potential price explosion in the coming weeks. The following is a detailed analysis of the main factors influencing the market.

Bitcoin versus Gold: Outstanding Performance

Bitcoin, often referred to as « digital gold », shows impressive performance against physical gold. The Bitcoin/Gold pair indicates that Bitcoin currently surpasses gold, reflecting increased investor confidence in this digital asset. A technical model called « Tasse with handle » is formed, a classic bullish signal that could announce a break in resistance and a fast rise in prices.

Open Interest and the growing rarity of Bitcoin

Open Interest, which measures traders’ interest in futures contracts, is at a high of 67 billion, signalling intense market activity. At the same time, the amount of Bitcoin available on exchange platforms is historically low (ATL). This imbalance between supply and demand could lead to a rapid rise in prices, reinforced by increasing demand and limited supply.

The Hash Rate: an indicator of the confidence of minors

The Hash Rate, an indicator of the computing power of miners, reaches parabolic levels. This shows that miners continue to support the network, a sign of confidence in the stability and profitability of Bitcoin. However, a sudden reversal of this trend could signal a change in the cycle, as observed in 2021 during the ban on mining in China.

Emerging narratives in the crypto ecosystem

DeFi sectors and small-capitalization tokens (Small Cap) are gaining popularity, while cryptos related to artificial intelligence remain timid. These trends offer interesting but risky investment opportunities. Investors need to monitor these narratives to identify the next phases of growth in the crypto market.

| Indicator | Description | Market impact |

|---|---|---|

| Bitcoin / Gold | Bitcoin surpasses physical gold, formation of a bullish model | Potential for higher prices |

| Open Interest | Achieved 67 billion, reporting high activity | Indicates increased volatility |

| Availability on trade | Historically low (ATL) | Probable increase in prices due to scarcity |

| Hash Rate | Power of calculation of miners in sharp increase | Trust of minors in the network |

| Crypto narratives | DeFi and Small Cap growing, AI still shy | Targeted investment opportunities |

Analysis of key cryptocurrency market indicators

In this section, we will explore key indicators to understand the current state of the cryptocurrency market. Julien Roman, in his video, highlights crucial metrics to assess trends and anticipate market movements. These indicators, such as MVRV, SOPR, Pure Multiple and Reserve Risk, allow us to discern the phases of euphoria or calm on the market. But how do we interpret these data and what implications for investors?

Over-purchase and over-sales indicators

Julien Roman points out that certain segments of the market, such as mid caps, show signs of awakening, while large capitalizations remain hesitant. Layer 2, with projects like Matic (Polygon), are also quiet. In contrast, bitcoin ETF volumes show a decrease in cash inflows (inflows) but few outflows (outflows). This reflects a period of uncertainty, similar to that observed in 2021. Do these data suggest an imminent market summit? Not yet, according to Julien, because the indicators show moderate activity, far from signs of extreme euphoria.

Focus on advanced metrics: MVRV, SOPR and others

Among the leading indicators, MVRV and SOPR have already triggered signals, but Pure Multiple, a key indicator of previous cycles, remains inactive. This indicates that the market is still in a phase of gradual growth. Julien also mentions the Reserve Risk, which remains stable, and a technical euphoria area identified by Check On Chain. However, he expresses doubts about this euphoria, calling it « timid ». Should we then accumulate or take profit? Julien recommends a cautious approach, taking profit gradually while monitoring the indicators.

| Indicator | Current status | Interpretation |

|---|---|---|

| MVRV | Signal triggered | Phase of progressive climb |

| SOPR | Signal triggered | Indicates moderate activity |

| Multiple Pure | Inactive | No market summit yet |

| Reserve Risk | Stable | No overheating detected |

FAQ

What is an « alt season » and how to recognize it?

What is an « alt season » and how to recognize it?

A « alt season » is a time when altcoins (cryptocurrency other than Bitcoin) experience a significant increase in their value. It is often preceded by a strong performance of Bitcoin, which draws attention to the cryptocurrency market. Indicators such as the Altcoin RSI and the Crypto Fear and Greed Index can help identify the beginning of an alt season.

What are the key indicators to analyze the Bitcoin market?

What are the key indicators to analyze the Bitcoin market?

Key indicators to analyze the Bitcoin market include Bitcoin Dominance, Altcoin RSI, Crypto Fear and Greed Index, Open Interest, Bitcoin’s availability on trade, and Hash Rate. These indicators help to understand market dynamics and anticipate price movements.

How does Bitcoin compare to gold today?

How does Bitcoin compare to gold today?

Currently, Bitcoin surpasses gold in terms of performance, reflecting increased investor confidence in this digital asset. A bullish technical model, called « cup with handle », is formed, suggesting a possible break in resistance and a rapid price rise.

What is Open Interest and why is it important?

What is Open Interest and why is it important?

Open Interest measures traders’ interest in futures contracts on Bitcoin. A high Open Interest, like the current 67 billion, indicates strong market activity, which can signal increased volatility and significant price movements.

Why is Bitcoin’s availability on exchanges important?

Why is Bitcoin’s availability on exchanges important?

Bitcoin’s availability on exchanges is an indicator of Bitcoin’s offer. Historically low availability, as at present, may indicate increasing scarcity, which could lead to higher prices due to increasing demand and limited supply.

What are the emerging sectors in the crypto ecosystem?

What are the emerging sectors in the crypto ecosystem?

Emerging sectors in the crypto ecosystem include decentralized finance (DeFi) and small-cap tokens (Small Cap), which are gaining popularity. Cryptos related to artificial intelligence are still timid, but these trends offer interesting investment opportunities.

What are the leading indicators for evaluating the cryptocurrency market?

What are the leading indicators for evaluating the cryptocurrency market?

Leading indicators for assessing the cryptocurrency market include MVRV, SOPR, Pure Multiple, and Reserve Risk. These metrics help discern the phases of euphoria or calm on the market and anticipate future movements.