| Theme | Description |

|---|---|

| What is financial investment? | Definition and objectives of financial investment, including types of investments. |

| How to choose a financial advisor? | Criteria for selecting a qualified and accredited advisor. |

| Investment strategies | Tips for beginners and experienced investors. |

| Become CIF | Conditions and steps to obtain the status of Financial Investment Advisor. |

Introduction to Financial Investment

Financial investment is an essential step for anyone who wants to grow their wealth or achieve long-term financial goals. But why is it so important to understand this field before starting? Simply because each investment decision has risks and opportunities that need to be assessed.

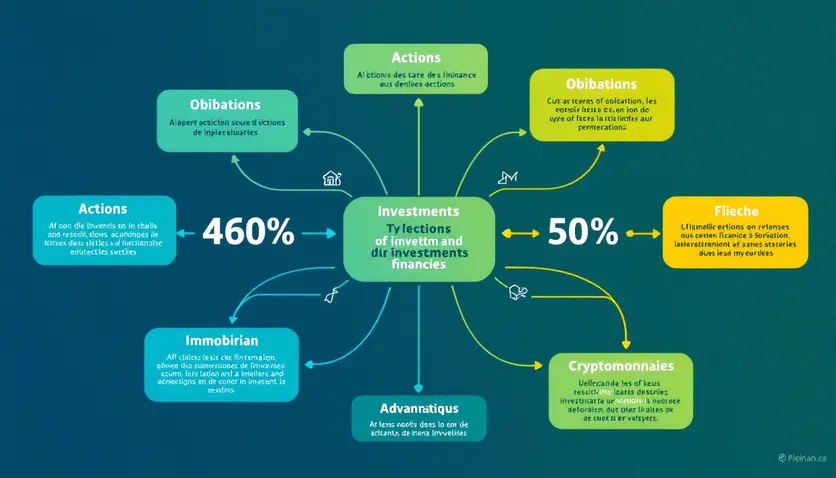

Financial investment encompasses a variety of investments, ranging from stock exchanges to bonds, real estate and cryptocurrency. Each type of investment has its own characteristics, advantages and disadvantages. For example, stocks can offer high returns, but they are also more volatile. Conversely, bonds are often perceived as safer, but with smaller returns.

Training and information is therefore crucial to avoid costly mistakes. This includes understanding the basis, such as diversification of investments, risk assessment and clear objectives. In addition, it is often wise to use a competent financial advisor to guide your choices, especially if you are new to this area.

Why invest?

Investing helps secure your financial future, prepare your retirement or finance important projects. But what are the main benefits of investment? First, it offers an opportunity to grow its capital, often at a faster pace than conventional savings. Second, it allows to diversify its sources of income, thus reducing dependence on a single financial flow, such as wages. Finally, investment can also be used to protect its assets from inflation, which erodes the value of money over time.

Types of investment

There are many options for investing, each adapted to different profiles and objectives. What are the main types of investments? Among the most common shares are the shares, which enable a company to become a shareholder and enjoy its growth. Bonds, on the other hand, are loans to companies or governments, offering fixed yields. Real estate is another popular option, offering both rental income and an appreciation of capital. Finally, cryptocurrency, although more recent and volatile, attracts many investors looking for high returns.

How to Choose a Financial Advisor?

Choosing a financial advisor is a crucial step to ensure your investments are successful. But how can we make sure we make the right choice? A competent financial advisor can help you define your goals, develop an appropriate strategy and avoid costly mistakes. However, not all advisors are valid, and it is essential to consider several criteria before committing yourself.

First, check the consultant’s qualifications and accreditations. In France, for example, a financial investment advisor (CIF) must be registered with ORIAS and comply with a strict code of ethics. This ensures that he has the skills to accompany you. Then evaluate his experience and specialization. Some advisors focus on specific areas, such as wealth management or stock exchange investments, which can be an asset if your needs match their expertise.

Finally, do not hesitate to ask questions about his working methods, fees and recommended financial products. A good advisor must be transparent and able to clearly explain his or her choices. By following these steps, you will maximize your chances of finding a reliable and competent professional.

Qualifications to be sought

To choose a financial advisor, it is essential to check his qualifications. What criteria should be preferred? In France, a financial investment advisor (CIF) must be registered with ORIAS, which ensures that he/she complies with legal and ethical standards. In addition, he/she must have recognized certifications, such as the degree of asset management advisor or specific accreditations for certain financial products. These qualifications are a guarantee of competence and professionalism.

The questions to ask

Before engaging with a financial advisor, take the time to ask questions to assess its competence and transparency. What are the key questions? Ask him what his past experiences and specialties are. Ask him about his working method: does he prefer a personalized approach or does he propose standardised solutions? Finally, find out about his fees and any conflicts of interest related to the products he recommends. A good advisor must be able to answer these questions in a clear and honest way.

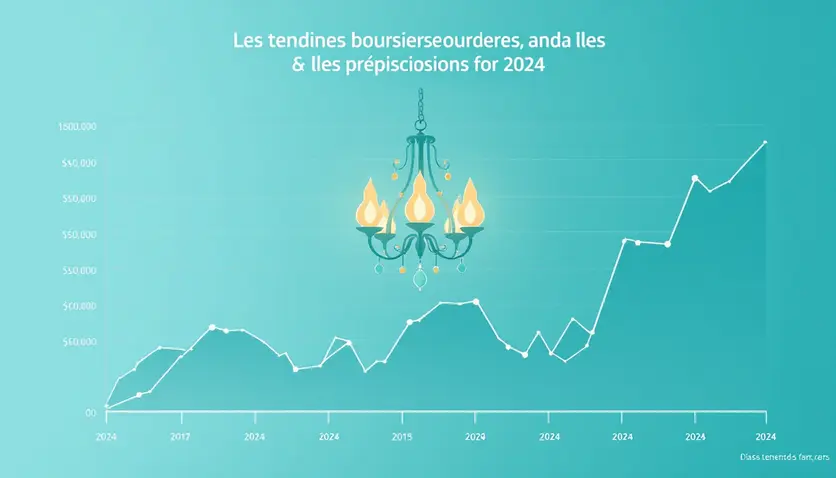

Investment strategies for 2024

The year 2024 offers many opportunities for investors, but it also requires a thoughtful approach adapted to your financial objectives. What are the best strategies for this year? It depends on your investor profile, risk tolerance and short- or long-term goals.

For beginners, it is often advisable to start with diversified investments, such as ETFs (listed index funds), which reduce risks while offering growth potential. More experienced investors can explore specific sectors, such as green technologies or renewable energies, which are expected to grow strongly in 2024.

The key to success is good planning and rigorous risk management. This includes defining clear objectives, diversifying your portfolio and regularly monitoring your investments. In addition, it is essential to keep informed about market trends and economic developments to adjust your strategy accordingly.

Invest in stock exchange for beginners

For those who start on the stock exchange, it is crucial to start with simple, low-risk investments. What are the first steps? First, define your financial goals and risk tolerance. Then, focus on products like ETFs, which offer instant diversification. Finally, learn on the basis of the stock exchange, such as reading graphs and analysing businesses, to make informed decisions.

How to invest 1000 euros efficiently

Even with a limited budget, it is possible to grow its capital. How to maximize an investment of 1000 euros? One option is to invest in low-cost ETFs that diversify your portfolio. You can also consider individual actions in promising sectors, such as technology or health. Finally, consider reinvesting your earnings to benefit from the long-term cumulative effect.

Market trends in 2024

The year 2024 is marked by several key trends that can influence your investment decisions. What areas are to be monitored? Green technologies, renewable energy and artificial intelligence are among the most promising areas. In addition, emerging markets offer interesting opportunities for investors willing to take calculated risks. Stay informed about economic and geopolitical developments to adjust your strategy accordingly.

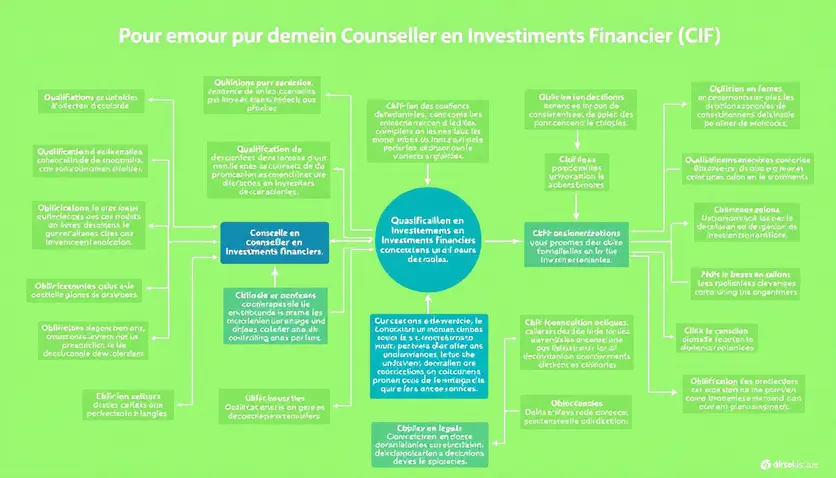

Become Financial Investment Advisor (FIC)

The status of Financial Investment Advisor (FIC) is essential to practice as a financial professional. But how to get this status and what are the steps to take? This title, regulated in France, ensures that the adviser respects strict standards of competence, ethics and transparency.

To become CIF, it is necessary to meet several conditions. First, the candidate must possess specific qualifications, such as a degree in finance, management or economics. Then, he must register with ORIAS, the body responsible for keeping the register of intermediaries in insurance, banking and finance. This registration also requires subscription to professional liability insurance, which protects both the advisor and his clients in case of litigation.

Compliance with legal and ethical obligations is also crucial. This includes the establishment of a clear process to assess the needs of clients and provide them with appropriate solutions. By following these steps, you can obtain the status of CIF and exercise it legally.

Prerequisites

To become Financial Investment Advisor (FIC), it is imperative to meet certain conditions. What are these conditions? First, the applicant must have a recognized diploma or certification in the field of finance, management or economics. Second, he must demonstrate relevant professional experience, often required to guarantee his skills. Finally, it is necessary to take out professional liability insurance, which is mandatory in order to protect customers and counsel him in the event of a dispute.

The accreditation process

Accreditation as a CIF takes several administrative steps. How to register and obtain this status? The first step is to register with ORIAS, the official body managing the financial intermediary register. This registration requires proof of qualification, a certificate of professional liability insurance and a commitment to respect the code of ethics. Once registered, the counsellor must also undergo continuous training to keep his/her skills up to date and remain in compliance with the regulations in force.

Conclusion: Success in your Financial Investments

Successful financial investments require a combination of knowledge, planning and discipline. What are the key elements to achieving your financial goals? First of all, understanding your needs and objectives is essential. Whether you are looking to secure your retirement, generate passive income or finance a specific project, your investment choices must be aligned with these objectives.

Then diversification is a golden rule. By allocating your investments to different assets, you reduce risks while increasing your chances of return. Also remember the importance of keeping informed. Financial markets are constantly evolving, and adapting your strategy to new opportunities and economic changes is crucial.

Finally, do not hesitate to seek financial investment advice from qualified professionals. Their expertise can help you avoid common mistakes and maximize your earnings. By following these principles, you will be better prepared to navigate the complex world of financial investment.

Errors to avoid

To succeed, it is equally important to know what to avoid. What are the most common mistakes? One of the main mistakes is not to diversify its portfolio, which exposes it to significant risks in the event of a fall in a sector or asset. Another common mistake is to blindly track market trends without analysing their relevance to your objectives. Finally, failing to regularly re-evaluate your strategy may prevent you from taking advantage of new opportunities or adjusting your investments to reflect economic changes.

Good practices to be adopted

Adopting good practices is essential to optimize your investments. What are the winning strategies? First, establish a clear financial plan with specific and measurable objectives. Second, focus on a long-term approach, as financial markets can be volatile in the short term. Finally, stay disciplined: avoid impulsive decisions based on emotions and follow your initial plan, while remaining flexible to adjust your strategy if necessary.

FAQ

How to choose a good financial advisor?

How to choose a good financial advisor?

To choose a good financial advisor, check his or her qualifications, such as registration with ORIAS and recognized certifications. Ask him about his experience, his specialties and his method of work. Also make sure that it is transparent about its fees and offers solutions tailored to your needs.

What is financial investment?

What is financial investment?

Financial investment consists of investing money in assets such as shares, bonds or funds, with the aim of generating a return or producing its capital over the long term.

What is the prerequisite for a CIF Advisor in Financial Investments to provide advice?

What is the prerequisite for a CIF Advisor in Financial Investments to provide advice?

A CIF must be registered with ORIAS, have professional liability insurance and adhere to a code of ethics. It must also assess the needs of its clients before providing advice.

How to become a financial investment advisor?

How to become a financial investment advisor?

To become a financial investment advisor, you must obtain financial or management qualifications, register with ORIAS, take out professional liability insurance and comply with legal and ethical obligations.

Should we invest in the stock market now?

Should we invest in the stock market now?

Investing in a stock exchange can be a good option, but it depends on your risk tolerance and your financial goals. It is important to diversify your investments and keep informed of market trends.

Where to find the best scholarship advice?

Where to find the best scholarship advice?

The best market advice can be obtained from qualified financial advisors, specialized platforms, or from market analyses by recognized experts.

How to invest in a beginner stock exchange?

How to invest in a beginner stock exchange?

To start on the stock exchange, start by defining your financial goals and risk tolerance. Invest in simple products like ETFs to diversify your portfolio and learn the basics of financial analysis.

How to invest 1000 euros well?

How to invest 1000 euros well?

To invest 1000 euros, choose low-cost ETFs to diversify your investments. You can also invest in promising shares or growing sectors, while reinvesting your earnings to maximize the cumulative effect.

What investments?

What investments?

The choice of actions depends on your goals and risk tolerance. In 2024, sectors such as green technologies, renewable energy and artificial intelligence are particularly promising.

How to get CIF status?

How to get CIF status?

To obtain the status of CIF, you must register with ORIAS, justify financial qualifications, take out professional liability insurance and comply with a strict code of ethics.