| Aspects | Description |

|---|---|

| Definition | The revolving credit is a reserve of money available at any time. |

| Use | Can be used for unforeseen expenses or purchases. |

| Refund | Payments including capital and interest. |

| Interest rates | Generally higher than conventional loans. |

| Benefits | Flexibility and immediate availability of funds. |

| Cautions | Manage well to avoid excessive debt. |

Introduction to the Caisse d’Epargne’s Renewable Credit

Revolving credit is a flexible financial solution that allows individuals to have a reserve of money that can be used at any time. Proposed by Caisse d’Epargne, this type of credit is designed to meet unforeseen needs or to finance personal projects without having to subscribe to a traditional loan. But what makes this product so special and why is it interesting?

Caisse d’Épargne, as a major player in the banking sector in France, offers advantageous conditions and personalized support for its clients. The revolving credit, often associated with the Izicarte card, allows you to manage your expenses flexibly while benefiting from simplified management thanks to the bank’s digital tools. However, understanding how it works is essential to avoid the pitfalls associated with this type of funding.

In this article, we will explore the bases of revolving credit, its advantages, its disadvantages, and the reasons why it is proposed by Caisse d’Epargne. You will also discover practical tips for optimal use.

What is a revolving credit?

Revolving credit is a reserve of money made available by a bank or credit agency. Unlike a traditional loan, there is no need to justify the use of funds. You can use all or part of this reserve, and it reconstitutions as refunds are made. This type of credit is particularly suitable for unforeseen expenses or one-time purchases.

Why choose the Caisse d’Epargne?

Caisse d’Epargne is distinguished by its expertise and customer approach. By opting for renewable credit from this bank, you benefit from personalized support, competitive rates and simplified management via powerful digital tools. In addition, the Izicarte card, often associated with this credit, offers additional features such as deferred payment.

Operation of Renewable Credit

Revolving credit is a flexible financial solution based on a simple principle: a reserve of money is made available to the borrower, who can use it in whole or in part according to their needs. This reserve is reconstructed as repayments are made, thus providing continued availability of funds.

When a customer subscribes to a revolving credit at Caisse d’Epargne, he benefits from simplified management thanks to the bank’s digital tools. Funds may be used for unforeseen expenses or personal projects without having to justify their use. However, it is important to note that this type of credit is often associated with higher interest rates than conventional loans.

The repayment is made in monthly instalments, which include a share of capital and interest. The borrower may also choose to repay in advance to reduce the total cost of the credit. This provides great flexibility, but requires rigorous management to avoid over-indebtedness.

How does the revolving credit work?

The revolving credit operates as a reserve of money made available by the bank. The borrower may use all or part of this reserve, as required. Once the funds have been used, they can be repaid by monthly instalments, which gradually replenishes the reserve. This cycle of use and reimbursement allows a unique flexibility, adapted to unforeseen needs.

Method of reimbursement

The repayment of the revolving credit is simple: the borrower repays a fixed sum each month, which includes a share of capital and a share of interest. Advance repayment is also possible, which reduces the total cost of the credit. However, it is crucial to understand the terms of repayment in order to avoid bad surprises.

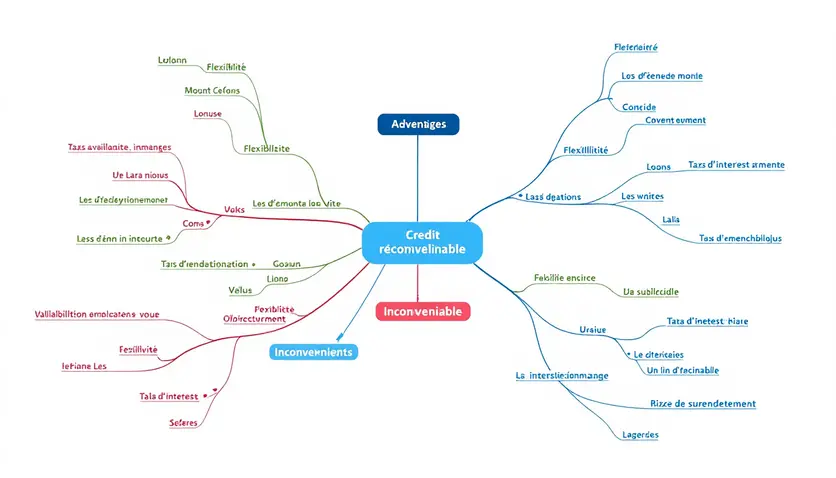

Benefits and Disadvantages of Renewable Credit

The revolving credit, proposed by Caisse d’Epargne, is a financial solution with both advantages and disadvantages. Understanding these aspects is essential to making an informed choice.

Among the main benefits are the flexibility and immediate availability of funds. This type of credit is ideal to meet unforeseen expenses or to finance projects without having to justify the use of funds. In addition, the reserve of money is reconstructed as repayments are made, providing an ongoing solution for financial needs.

However, the revolving credit also has limits. Interest rates are often higher than conventional loans, which can increase the total cost of credit. There is also a risk of over-indebtedness if the borrower does not properly manage its expenses and repayments.

In this section, we will analyze in detail the strengths and limitations of revolving credit to help you better understand its implications.

The advantages of revolving credit

Revolving credit offers great flexibility thanks to the immediate availability of funds. It is particularly suitable for unforeseen expenses or projects requiring rapid funding. In addition, the possibility of replenishing the reserve as repayments progress makes it a practical and continuous solution.

Risks and precautions

Despite its benefits, revolving credit presents risks. High interest rates can make this type of credit expensive in the long term. It is crucial to manage your repayments well to avoid over-indebtedness and compare offers to choose the one that best meets your needs.

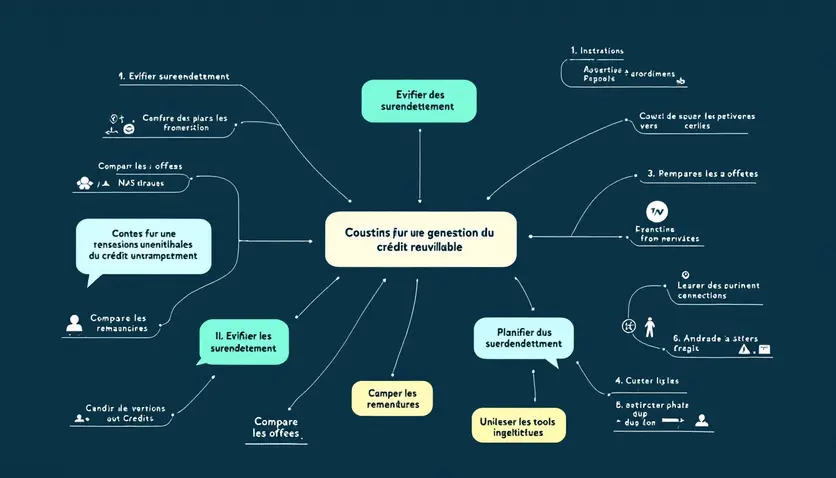

Tips for Optimal Management

Managing a revolving credit, such as that proposed by Caisse d’Epargne, requires a thoughtful approach to avoid financial pitfalls. Optimal management is based on rigorous planning and responsible use of funds.

To begin with, it is essential to understand the terms of your revolving credit, including interest rates and repayment terms. This will help you avoid bad surprises and better plan your expenses. The use of digital tools, such as those offered by Caisse d’Epargne, can also facilitate the management of your credit.

In this section, we offer practical tips to make the most of your revolving credit while minimizing risks. These tips will help you use this type of funding responsibly and effectively.

Avoid over-indebtedness

Overindebtedness is one of the main risks associated with revolving credit. To avoid it, it is crucial not to use all of your money reserve without a clear repayment plan. Establish a specific budget and respect it to avoid a difficult financial situation.

Compare offers

Before you subscribe to a revolving credit, take the time to compare the different offers available on the market. Look for competitive interest rates and flexible repayment terms to choose the option that best suits your needs.

Conclusion: Renewable Credit, a Flexible Solution but to Use with Prudence

The revolving credit, as proposed by the Caisse d’Epargne, is a financial solution that combines flexibility and accessibility. It quickly responds to unforeseen financial needs while providing a reconstitutionable reserve of money. However, this flexibility has a cost, especially because of the often high interest rates and the risk of over-indebtedness.

To make the most of this type of credit, it is essential to understand and use its mechanisms responsibly. Establishing a clear budget, comparing offers and planning repayments are key steps to avoid financial traps.

In conclusion, revolving credit can be a valuable tool for managing your finances, provided you use it with caution and discernment. Take the time to assess your needs and repayment capabilities before committing.

Summary of advantages and disadvantages

Revolving credit offers great flexibility and immediate availability of funds, making it a practical solution for unforeseen events. However, high interest rates and the risk of over-indebtedness are major drawbacks. It is crucial to weigh these aspects before accepting.

Final recommendations

For optimal use, focus on rigorous management of your renewable credit. Use the digital tools to track your expenses, reimburse in advance if possible, and avoid using your entire reserve without a clear plan.

FAQ

How does the revolving credit of the Caisse d’Epargne work?

How does the revolving credit of the Caisse d’Epargne work?

The revolving credit of the Caisse d’Epargne is a reserve of money made available to the borrower. You can use all or part of this reserve according to your needs, and it is re-established as refunds are made. This type of credit is ideal for unforeseen expenses or personal projects.

What is the Caisse d’Epargne revolving credit?

What is the Caisse d’Epargne revolving credit?

The Caisse d’Epargne revolving credit is a flexible financial solution that allows access to a usable reserve of money at any time. It is often associated with the Izicarte card, which offers additional features such as deferred payment.

How to repay a revolving credit to the Caisse d’Epargne?

How to repay a revolving credit to the Caisse d’Epargne?

Reimbursement of a revolving credit to the Caisse d’Epargne is made by fixed monthly instalments, including a share of capital and interest. You can also repay early to reduce the total cost of the credit.

How does the Izicarte card of Caisse d’Epargne work?

How does the Izicarte card of Caisse d’Epargne work?

The Izicarte card is associated with the revolving credit of the Caisse d’Epargne. It allows you to manage your expenses flexibly, thanks to options such as deferred payment or payment in multiple times.

How to use the Caisse d’Epargne revolving credit?

How to use the Caisse d’Epargne revolving credit?

To use the revolving credit, you can access the reserve of money made available by Caisse d’Epargne. Funds may be used for unforeseen expenses or personal projects without having to justify their use.

How to terminate Izicarte at Caisse d’Epargne?

How to terminate Izicarte at Caisse d’Epargne?

To cancel the Izicarte card, you must contact your advisor at Caisse d’Epargne. Make sure you have fully repaid the associated revolving credit before requesting termination.

How to repay his credit Izicarte?

How to repay his credit Izicarte?

The repayment of the Izicarte credit shall be made by fixed monthly instalments, including a share of capital and interest. You can also opt for an advance refund to reduce the total cost.

How does Izicarte credit work?

How does Izicarte credit work?

Izicarte credit is a revolving credit associated with the Izicarte card of the Caisse d’Epargne. It offers a reserve of money usable at any time, with deferred payment options or in multiple times.