| Economic agents | Methods of financing |

|---|---|

| Households | Disposable income, savings, real estate investments |

| Enterprises | Self-financing, bank borrowing, equity and bond issues |

| Public administrations | Tax revenue, borrowing in case of budget deficit |

Introduction

In the modern economic world, understanding how economic agents finance themselves has become a crucial issue in understanding the financial dynamics of our society. Recent developments, including developments in financial markets and the investment strategies of major players such as Bill Ackman, underline the importance of controlling these financing mechanisms.

Economic agents – households, businesses and public administrations – are the pillars of our economic system. Each officer has his own sources and methods of fundingadapted to its specific needs and constraints. Households rely mainly on disposable income and savings, businesses combine self-financing with external resources, while public administrations use taxation and borrowing.

Interconnection between these different agents creates a complex financial ecosystem where individual financing decisions impact the entire economy. For example, household savings can be used to finance business investment or public debt, creating a virtuous cycle of financing the economy.

Economic context

The current economic environment, characterized by fluctuating interest rates and market volatility, directly influences the financing choices of economic agents. Recent market trendsAs Yahoo Finance news shows, there is a constant adaptation of financing strategies. Institutional investors adjust their portfolios, while individuals seek secure investment options, including through dividends and secure savings.

Objectives of the article

The purpose of this article is to demystifying funding mechanisms and to provide a clear understanding of their interactions. We will explore the various sources of funding available, their benefits and limitations, and their impact on the global economy. This analysis will allow readers to better understand the financial choices available to them and the implications of these choices for the entire economic system.

Households and their Financing

Households are a fundamental pillar of the economy and their financing is constantly evolving in the face of current economic challenges. According to the latest financial news, the management of household wealth is becoming increasingly sophisticated, especially with the emergence of new investment and savings options.

Disposable income remains the main source of household financing, consisting of wages, capital income and social benefits. According to recent market analyses, diversification of revenue sources becomes crucial, particularly in a context of economic volatility. Households are increasingly moving towards investments that generate stable dividends, as evidenced by current investment trends in sustainable dividend shares.

Savings plays a central role in household financial strategy. Recent news highlights the growing importance of retirement planning and the management of minimum distribution requirements (MDAs). Households diversify their investments between traditional savings, real estate investments, and more sophisticated financial products. This trend reflects an increased awareness of the importance of balanced and predictable financial management.

Income Available

Disposable income forms the basis of household financing. Recent financial analyses show changes in the composition of these revenueswith increasing importance of capital income and social benefits in addition to traditional wages. Households today need to juggle different sources of income to maintain their standard of living, particularly in the context of inflation and changes in interest rates.

Savings and investment

Household savings are changingadapted to new economic realities. Recent news highlights the growing attraction for investments generating regular income, such as dividend shares. Households now favour a mixed approach, combining precautionary savings, real estate investments and financial investments, to optimize their returns while managing risks.

Financing of enterprises

Business financing has diversified considerably In recent years, as recent financial news shows. Companies now have a wide range of sources of financing, ranging from traditional methods to innovative solutions. Recent news shows that even large companies like Nike are the subject of major investments, illustrating the importance of external financing in the business growth strategy.

Self-financing remains a key source for many businesses. This ability to generate own funds allows for greater financial autonomy and resilience to market hazards. Undistributed profits, depreciation and provisions are the main components of self-financing.

External financing, on the other hand, has become more complex with developments in financial markets. Companies can now use a variety of options: traditional bank loans, bond issues, fund-raising with private investors, and introduction to the stock exchange. Current trends show growing preference for hybrid financing, combining different sources to optimize the cost of capital and financial flexibility.

Traditional sources

Traditional sources of financing remain essential for businesses. Bank borrowing and self-financing form the basis for entrepreneurship financing. Financial developments underline the importance of maintaining a balance between these different sources, particularly in the context of fluctuating interest rates. Large companies, as demonstrated by recent institutional investor transactions, continue to favour a diversified approach combining internal and external financing.

Financial Innovations

The corporate financing landscape is changing rapidly with the emergence of new solutions. Crowdfunding, crowdfunding platforms and innovative financial technologies offer new opportunities. Recent news shows a growing interest in these alternatives, particularly among startups and growing companies. These innovations allow more direct access to investors and greater flexibility in the financing structure.

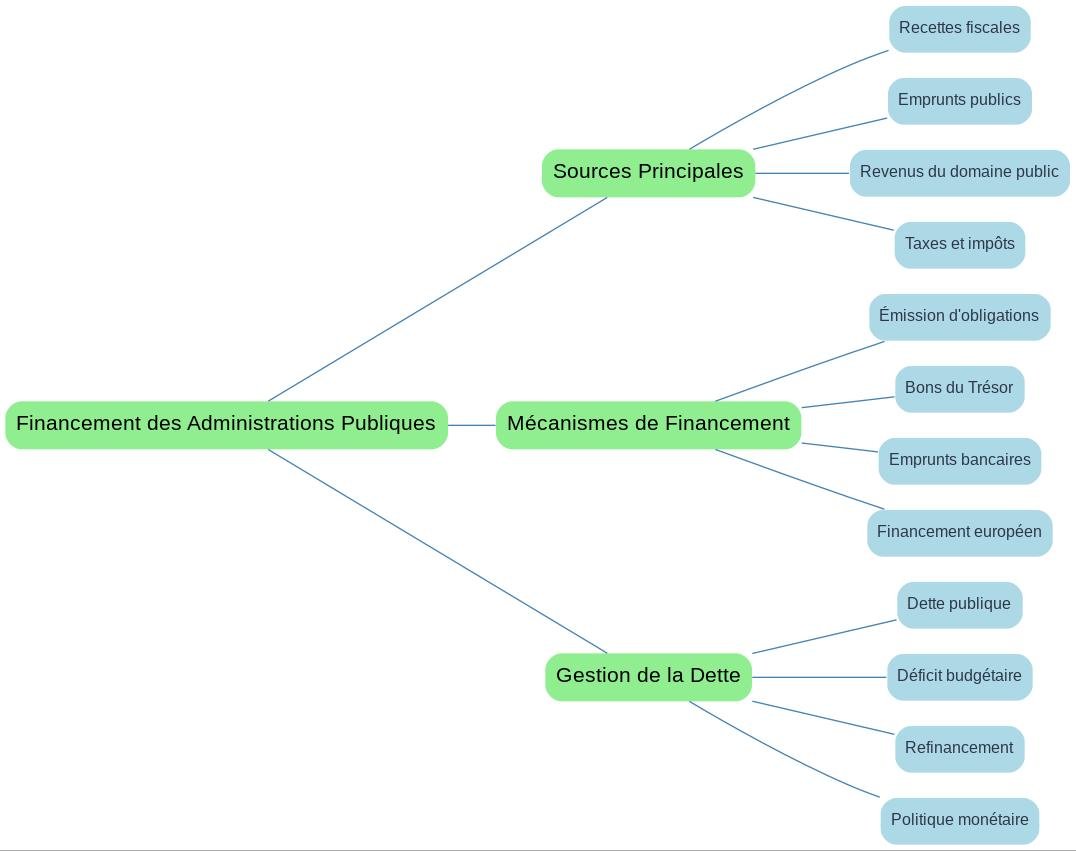

Public Administrations and Financing

Government financing is a major issue for the economic balance of a country. Tax revenues are the main source of financing, complemented by other mechanisms such as public borrowing. In the current context, the management of these funds is becoming increasingly complex, particularly in the face of economic challenges and growing needs for public services.

General government relies on a diversified system of funding sources. Taxes and taxes, whether direct or indirect, represent the majority of revenues. These resources are supplemented by revenues from the public domain, government borrowing and various other sources such as European funding for specific projects.

Public debt management has become a central element in the government funding strategy. Recent financial news shows the growing importance of bond markets and Treasury bills in public financing. This debt must be managed carefully to maintain investor confidence while ensuring the financial stability of the State.

Tax revenue

Tax revenues form the basis of public financing. Collection and effective management of taxes are essential for ensuring public services and maintaining fiscal balance. Recent news highlights the importance of a balanced fiscal policy, capable of generating sufficient income while preserving the economic competitiveness and purchasing power of citizens.

Debt Management

Public debt management requires a sophisticated strategic approach. Governments need to balance their financing needs with financial market constraints. Current trends show a shift towards more diversified debt instruments and increased attention to long-term debt sustainability, particularly in the context of fluctuating interest rates.

Conclusion

Understanding the financing mechanisms of economic agents is fundamental to understanding the functioning of our modern economy. The in-depth analysis of different financing methods reveals a complex interdependence between households, businesses and government. Recent financial news highlights the constant evolution of these mechanisms, particularly in the face of contemporary economic challenges.

The effectiveness of the economic system depends on complementarity sources of funding. Households, through savings and consumption, feed the economic circuit. Companies, through their various financing options, can invest and create value. Public administrations, for their part, ensure the stability of the system through their fiscal policies and debt management.

Current trends, as shown by the flow of financial information, indicate that deep transformation of funding. Financial innovation, digitalisation of services and the emergence of new forms of investment are constantly redefining the opportunities offered to economic agents. This requires continuous adaptation of financing strategies to meet the changing needs of the economy.

Future prospects

The future of financing economic agents is moving towards greater diversification and digitalisation. Technological and financial innovations new perspectives, as evidenced by recent news on fintech and new funding models. This trend promises increased opportunities but also requires increased vigilance in the face of emerging risks.

Practical recommendations

To optimize their financing, economic agents must adopt a strategic and informed approach. Households would benefit from diversifying their savings, businesses to balance their sources of financing, and governments to maintain rigorous management of their resources. These recommendations are based on best practices and analyses by financial experts.

FAQ

What are the main sources of household financing?

What are the main sources of household financing?

Households are financed mainly by disposable income (wage, capital income, social benefits) and savings. They can also use bank loans for specific projects such as real estate. The diversification of investments between traditional savings, real estate investments and financial products makes it possible to optimize their financial situation.

What are the different financing methods available to businesses?

What are the different financing methods available to businesses?

Companies have several sources of financing: self-financing (undistributed earnings, depreciation), bank loans, bond issuance, fund-raising with private investors, introduction to the stock exchange, and new solutions such as crowdfunding. The combination of these sources makes it possible to optimize their financial structure.

How do public administrations finance them?

How do public administrations finance them?

Public administrations are financed mainly by tax revenues (direct and indirect taxes), public domain revenues, and public borrowing through the issuance of Treasury bills and government bonds. European funding can also complement these resources for specific projects.

How important is self-financing for a company?

How important is self-financing for a company?

Self-financing is crucial because it allows businesses to have greater financial autonomy and resilience to market hazards. It consists of undistributed profits, depreciation and provisions, thus providing a stable source of financing independent of external constraints.

How can households optimize their savings strategy?

How can households optimize their savings strategy?

Households can optimize their savings strategy by diversifying their investments between precautionary savings, real estate investments and financial products. A balanced approach between safety and performance, tailored to their personal objectives and investment horizon, is recommended.

What are the challenges of managing public debt?

What are the challenges of managing public debt?

The management of public debt requires maintaining a balance between the financing needs of the State and investor confidence. The main issues are controlling borrowing costs, long-term debt sustainability and adapting to fluctuations in interest rates.

What are recent innovations in business financing?

What are recent innovations in business financing?

Recent innovations include crowdfunding, crowdfunding platforms, and fintech solutions. These new tools allow more direct access to investors and provide greater flexibility in the financing structure, particularly adapted to start-ups and growing businesses.

How does the financing of economic agents evolve in the face of digitalisation?

How does the financing of economic agents evolve in the face of digitalisation?

Digitalisation profoundly transforms financing modes with the emergence of digital financial services, online investment platforms and innovative payment solutions. This evolution facilitates access to financing while requiring ongoing adaptation of financial strategies.