| Age | Recommended saving | Main objectives |

|---|---|---|

| 30 years | 6 months to 1 year salary | Precautionary saving, start of investments |

| 40 years | Savings for future projects | Preparation for retirement, long-term investments |

| 50 years | 6 years’ salary | Pension consolidation, asset diversification |

Introduction: Why saving at 30 is crucial

At 30, financial life often takes a decisive turn. It is a time when responsibilities are increasing, whether it is to repay student loans, plan to buy a home or start saving for retirement. Saving at this age is essential to laying the foundations for sustainable financial stability.

30-year savings are not limited to accumulating money in a bank account. It represents a proactive strategy to protect against unforeseen events, achieve medium- and long-term goals, and benefit from the impact of compound interests. The sooner you start saving, the more time your money has to grow, which can make a significant difference in your financial future.

However, it is also crucial to know how to save effectively. This includes creating precautionary savings, establishing clear financial targets and exploring investment options tailored to your profile. The goal is to balance your current needs with your future ambitions.

In this section, we will explore the specific financial challenges of this age and the benefits of well-planned savings.

Financial challenges at 30 years

At 30, many individuals face significant financial challenges. This may include repayment of student debts, management of independent living expenses, or planning expensive projects such as buying a home or marriage. These growing responsibilities make saving all the more crucial. Without a clear savings strategy, it is easy to be overwhelmed by these financial obligations.

The benefits of early savings

Starting to save early offers considerable benefits. One of the most important is the effect of compound interests, which allows your money to grow exponentially over time. For example, a small amount invested regularly at age 30 can become a significant amount at retirement age. Saving early is also about giving oneself the freedom to seize future opportunities, such as a career change or an important journey.

How much to save at 30 years: Financial benchmarks

At the age of 30, it is essential to have a clear idea of how much to save to ensure financial stability and achieve your long-term goals. Experts generally recommend having a savings equivalent to 6 months to 1 year net salary. This money provides a solid basis for dealing with unforeseen events, such as job losses or unforeseen medical expenses.

In addition to precautionary savings, it is advisable to start saving for future projects. This may include buying a home, a major trip or preparing for your retirement. The goal is to divide your savings between short-term needs and long-term investments.

To reach these financial benchmarks, it is crucial to put in place a strategy tailored to your situation. This may include creating a budget, automating your savings and exploring investment options. In the following subsections, we will detail these aspects to help you structure your savings.

Precautionary saving: how much to put aside?

Precautionary savings are a priority at 30 years. It must cover between 3 and 6 months of your current expenses or up to 1 year if your job situation is unstable. This saving protects you against financial unforeseen events, such as job loss or costly repairs. To build up this reserve, start by saving a fixed percentage of your income each month, ideally between 10% and 20%.

Savings for future projects

In addition to precautionary savings, it is important to set aside specific projects. This may include buying a house, a wedding or a trip. For these purposes, it is recommended to use dedicated savings accounts or medium-term investments. For example, a housing savings plan (HSP) may be a good option to prepare for the purchase of real estate.

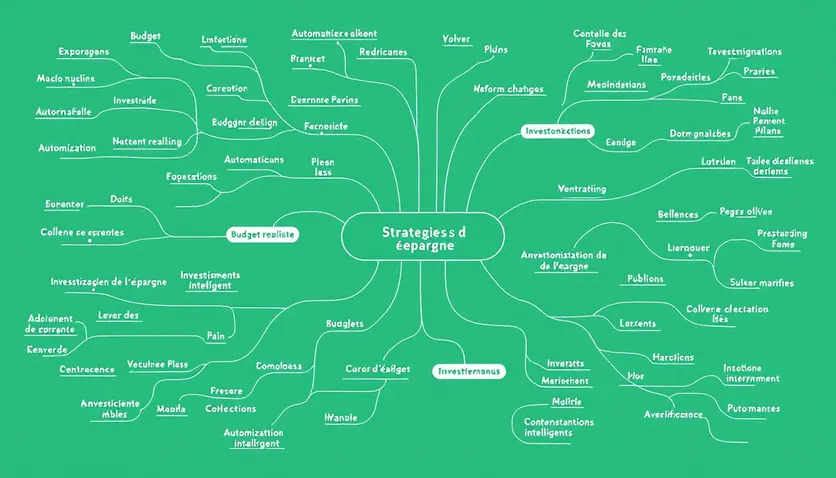

Savings strategies adapted to 30 years

At 30, it is essential to put in place effective savings strategies to achieve your financial goals. The main objective is to balance your current needs with your future ambitions. This means structuring your finances to maximize your savings while maintaining a comfortable lifestyle.

Savings strategies adapted to this age include creating a realistic budget, automating your savings and investing in adapted financial products. These approaches ensure regular savings and help your money grow over the long term. By adopting these methods, you can not only secure your financial future, but also take advantage of opportunities.

In the following subsections, we will detail these strategies to help you structure your savings optimally.

Creating a realistic budget

The first step in saving effectively is to create a realistic budget. This means tracking your income and expenses to identify areas where you can reduce your costs. A well-structured budget allows you to release savings funds without compromising your basic needs. Use digital tools or apps to track your finances and adjust your budget according to your priorities.

Automate your savings

The automation of savings is a simple but powerful method to guarantee regular savings. Set up automatic transfers from your current account to a dedicated savings account each month. This approach eliminates the risk of forgetting to save and helps you stay disciplined in your finances. You can also automate your investments to maximize the growth of your capital.

Investing smartly

At 30, it’s time to start investing to grow your money. Popular options include ETFs, pension savings plans or investments in shares or bonds. The goal is to diversify your investments to minimize risks while maximizing returns. Make sure you understand financial products before investing and, if necessary, consult with a financial advisor.

Savings mistakes to avoid

Saving effectively at 30 years requires not only good strategies, but also avoiding some common mistakes that can compromise your efforts. These errors, often related to lack of planning or impulsive decisions, can have a significant impact on your financial future.

One of the most common mistakes is to underestimate the importance of precautionary savings. Without this reserve, you may have to resort to expensive credits in case of unforeseen circumstances. Another common error is investing without understanding the associated risks, which can result in significant losses. By avoiding these pitfalls, you can maximize your chances of financial success.

In the following subsections, we will examine these errors in detail and how to avoid them to optimize your savings.

Underestimating the importance of precautionary savings

Precautionary saving is often neglected, but it is essential to deal with unforeseen events. Without this reserve, you may be forced to contract costly debts to cover unexpected expenses, such as repairs or medical expenses. To avoid this error, aim to save 3 to 6 months of your current expenses. This will provide you with financial security and reduce your stress in case of a hard blow.

Investing without understanding risks

Investing can be a great way to grow your money, but it also carries risks. A common mistake is to invest without understanding the mechanisms or implications. This can lead to significant losses, especially if you invest in complex or volatile financial products. Take the time to inform yourself, diversify your investments and, if necessary, consult with a financial advisor to avoid this error.

Conclusion: Plan Your Future Today

Saving at 30 is a crucial step in building a strong financial future. The decisions you make today will have a significant impact on your safety and future opportunities. Whether it’s a precautionary savings, planning medium-term projects or investing smartly, each action counts.

It is important to remember that saving is not a constraint, but an opportunity to prepare for the unexpected and realize his dreams. By adopting appropriate strategies and avoiding common mistakes, you can maximize your chances of financial success.

Take the time to assess your current situation, set clear goals and put in place an action plan. The sooner you begin, the more you will benefit from the cumulative effect of your efforts. In the following subsections, we will summarize the key points and give you practical tips for taking action.

Summary of key points

Throughout this article, we explored the essential aspects of saving at age 30. We stressed the importance of building precautionary savings, planning for future projects and investing intelligently. These are the pillars of a successful financial strategy. By avoiding common mistakes, such as lack of planning or misinformed investments, you can secure your financial future.

Tips for taking action

To start saving efficiently, follow these simple steps: establish a realistic budget, automate your savings and diversify your investments. Set clear financial targets and monitor your progress regularly. Do not hesitate to consult a financial advisor to optimize your strategy and maximize your results.

FAQ

How much money should we have aside at 30?

How much money should we have aside at 30?

At age 30, it is recommended to have a savings equivalent to 6 months to 1 year net salary. This money provides a solid basis for dealing with unforeseen events and for planning long-term projects.

What heritage should we aim for at 30?

What heritage should we aim for at 30?

At 30 years of age, wealth can vary according to income and financial choices. The main objective is to create a precautionary savings and to start investing to make its capital grow.

What amount to set aside every month at 30 years?

What amount to set aside every month at 30 years?

It is advisable to set aside between 10% and 20% of your monthly income. This proportion may vary depending on your financial objectives and current expenditures.

How to save efficiently at 30?

How to save efficiently at 30?

To save efficiently, start by establishing a realistic budget, automate your savings and invest in financial products tailored to your profile. Set clear goals and monitor your progress regularly.

How much savings should we be at 40?

How much savings should we be at 40?

At age 40, it is recommended to have a savings equivalent to 2 to 3 times your annual net salary. This allows you to secure your future while continuing to invest for retirement.

How many are you next door at 25?

How many are you next door at 25?

At age 25, savings depend heavily on income and priorities. The aim is to start building a precautionary savings, ideally equivalent to 3 to 6 months of current expenditure.

How much to be next to 50?

How much to be next to 50?

At age 50, it is advisable to have a savings equivalent to 4 to 6 times your annual net salary. This includes investments in retirement and solid precautionary savings.

How much money does it take to be financially serene?

How much money does it take to be financially serene?

To be financially serene, it is recommended to have a precautionary savings covering 6 months of current expenses, as well as a savings dedicated to your projects and retirement.