| Aspects | Details |

|---|---|

| Promising Cryptos | List of cryptos to watch in 2024 |

| Technical analysis | Key methods and indicators |

| Analysis tools | Recommended software and platforms |

| Investment advice | Strategies to maximize earnings |

| Promising projects | Criteria for evaluating crypto projects |

Crypto Analysis: Cryptocurrencies Promisers for 2024

The year 2024 promises to be a pivotal period for cryptocurrency, with many investment opportunities on the horizon. What crypts could explode this year? This article explores promising cryptocurrency, using technical analysis and expert predictions. We will guide you through the tools necessary to carry out these analyses and will offer you practical advice to invest wisely. Find out how to identify promising crypto projects and the most reliable exchange platforms. In conclusion, 2024 could be marked by significant changes in the world of cryptocurrency. How can you take advantage of these opportunities? By staying informed and using the right analysis tools, you can identify promising cryptos and invest in an informed way. Stay vigilant and continue to educate yourself to maximize your chances of success in this ever-changing universe.

Cryptocurrencies to watch

Presentation of cryptocurrencies that have the potential to explode in 2024 according to experts and current market trends. Investors need to pay attention to projects that offer innovative solutions and are increasingly adopted. Cryptocurrency such as Ethereum, Solana, and Cardano continue to show growth potential, but new arrivals such as Polkadot and Avalanche also attract attention. Monitoring technological developments and strategic partnerships that could influence their value is crucial.

Analysis tools and techniques

Exploration of the most effective analytical tools and techniques to assess the potential of cryptocurrency. Investors often use technical analysis tools such as candlestick charts, moving averages, and volume indicators to make informed decisions. In addition, fundamental analysis, which includes the evaluation of the development team, the project roadmap, and use cases, is essential to understand the long-term viability of a cryptocurrency. Using data analysis platforms like Glassnode and CoinMetrics can provide valuable insights.

Tools Indispensable for Technical Analysis of Cryptos

In the dynamic world of cryptocurrency, technical analysis is an essential tool for investors and traders seeking to maximize their profits. Crypto analysis is based on the use of sophisticated tools to decode market trends and make informed decisions. This section explores the essential tools to perform effective technical analysis of cryptocurrencies, focusing on their key features and benefits.

TradingView and its Features

TradingView is one of the most popular tools for technical analysis of cryptos. It offers real-time graphics, a wide range of technical indicators, and the possibility to create custom alerts. Why is TradingView so popular with traders? Because it allows for a thorough analysis and a clear visualisation of market data, thus facilitating decision-making.

Coinigy and CryptoCompare

Coinigy and CryptoCompare are also valuable tools for cryptocurrency traders. Coinigy is distinguished by its ability to integrate several trading platforms, thus providing an overview of the market. CryptoCompare provides detailed market data and comparative analysis. How do these tools help optimize investment strategies? By providing accurate and real-time information, they allow users to adjust their strategies to market fluctuations.

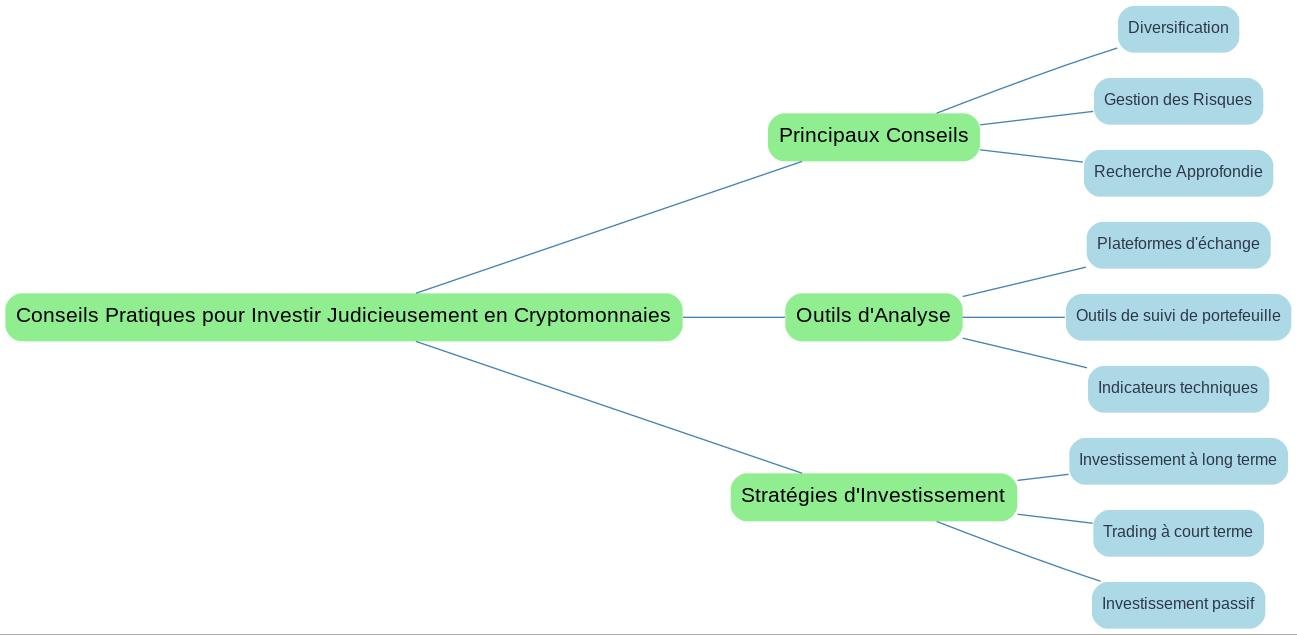

Practical Tips for Investing Judiciously in Cryptocurrencies

Investing in cryptocurrency can be a lucrative enterprise, but it requires a thoughtful and informed approach. Crypt analysis is essential to making informed decisions. This section will guide you through practical tips to navigate the complex world of cryptocurrencies, focusing on diversification, risk management and the importance of in-depth research. By using the right tools and adopting appropriate investment strategies, you can maximize your chances of success in this dynamic environment.

Diversification and Risk Management

Diversification is a key strategy to minimize risks in cryptocurrency investment. By dividing your investments over multiple assets, you reduce the potential impact of one asset’s volatility on your global portfolio. How can you effectively diversify your crypto portfolio? Understanding the different types of cryptocurrency and their roles in the market is crucial. In addition, risk management involves setting clear limits for your investments and never investing more than you can afford to lose.

Use of Analysis Tools

Effective analytical tools are essential to investing wisely. These tools include exchange platforms that offer advanced graphics, portfolio tracking tools to monitor your investments, and technical indicators to analyze market trends. What are the most reliable crypto analysis tools? By choosing the right tools, you can get valuable information that will help you make informed investment decisions.

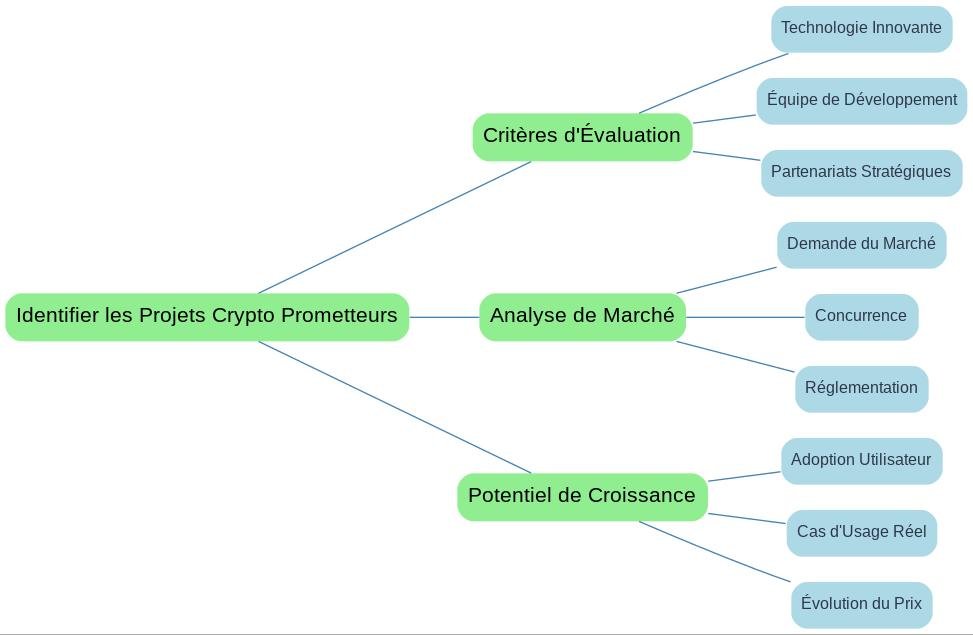

Identify Crypto Promitter Projects

In the constantly changing world of cryptocurrency, identify promising projects is essential for any investor wishing to maximize their earnings. This section guides you through the key criteria to assess the growth potential of crypto projects. Based on market analyses and expert forecasts, you will be able to identify projects that are most likely to succeed. We will address the technological aspects, development teams, and strategic partnerships that can influence the success of a project.

Project evaluation criteria

In evaluating a crypto project, it is crucial to consider several criteria. What are the key elements to analyze? First, the underlying technology must be innovative and solve a real problem. Next, the development team must be competent and experienced. Finally, strategic partnerships can play a key role in the success of a project.

Market Analysis and Growth Potential

Market analysis is a crucial step in identifying promising crypto projects. How to assess the growth potential of a project? It is important to examine market demand, existing competition, and existing regulations. Moreover, growth potential can be assessed by looking at user adoption, actual use cases, and price trends.

Conclusion

The year 2024 promises to be a pivotal period for cryptocurrency, with many opportunities and challenges ahead. Crypto analysis highlighted promising cryptocurrency, the tools needed for effective technical analysis, and sound investment strategies. Investors must remain vigilant and informed in order to navigate this constantly changing environment.

Cryptocurrencies continue to capture the attention of investors and experts around the world. Current trends show a growing adoption of blockchain technologies and a diversification of crypto projects. The outlook for 2024 includes increased regulation, wider institutional adoption, and the emergence of new technologies that could transform the financial landscape.

In conclusion, it is essential for investors to remain informed and adapt to rapid market changes. Using the tools and strategies presented in this article, they can maximize their chances of success in the dynamic world of cryptocurrency.

Summary of Key Points

In this article, we explored cryptocurrencies that could explode in 2024, essential technical analysis tools, and practical tips for investing wisely. We also discussed methods to identify promising crypto projects and reliable exchange platforms. These elements are crucial to effectively navigate the cryptocurrency market.

Prospects for the future

The future of cryptocurrency in 2024 seems promising with technological innovations and increasing adoption. Investors must be prepared to adapt to new regulations and market developments. What will be the next big crypto projects? Only time will tell us, but one thing is certain: the potential for growth remains immense.

FAQ

What crypt will explode?

What crypt will explode?

It is difficult to predict with certainty what cryptocurrency will explode. However, it is advisable to track market trends, partnership announcements and technological developments to identify cryptos with growth potential.

What crypt will explode in 2024?

What crypt will explode in 2024?

Predicting which cryptocurrency will explode in 2024 requires in-depth analysis of current trends, technological innovations and market movements. It is recommended to follow expert analyses and industry news.

How to do a crypto technical analysis?

How to do a crypto technical analysis?

To perform a crypto technical analysis, use tools such as candlestick graphics, moving averages, and RSI indicators. These tools will help you identify trends and potential entry or exit points.

What crypto analysis tool?

What crypto analysis tool?

There are several tools for crypto analysis, such as TradingView, Coinigy, and CryptoCompare, which offer advanced features for technical and fundamental analysis.

What crypto to put?

What crypto to put?

The choice of the cryptocurrency to invest depends on your risk tolerance, your financial goals and your market analysis. Diversifying your portfolio can also reduce risks.

What Crypto is untraceable?

What Crypto is untraceable?

Monero (XMR) is often cited as an untraceable cryptocurrency due to its advanced privacy features.

Where to find out about Crypto?

Where to find out about Crypto?

For information on cryptocurrency, visit specialized sites such as CoinDesk, CoinTelegraph, and forums such as Reddit. Following experts on social networks can also be useful.

Where to buy Populous?

Where to buy Populous?

Populous (PPT) can be purchased on cryptocurrency exchange platforms such as Binance, Bittrex, or KuCoin. Make sure to check availability on your preferred platform.

How to analyze Crypto projects?

How to analyze Crypto projects?

To analyze crypto projects, look at the white paper, the team behind the project, the partnerships, and the community. Assessing the technology and usefulness of the project is also crucial.

How to do a Crypto technical analysis?

How to do a Crypto technical analysis?

Crypto technical analysis involves the use of graphs and indicators to predict price movements. Tools such as Bollinger tapes, MACD, and RSI are commonly used.