| Term | Definition |

|---|---|

| Bull Run | Period of significant price increase in financial markets. |

| Bear Market | Period of prolonged market price decline. |

| ATH (All Time High) | The highest price ever reached by an asset. |

| Halving | Event halving the reward of Bitcoin miners, potentially influencing the price. |

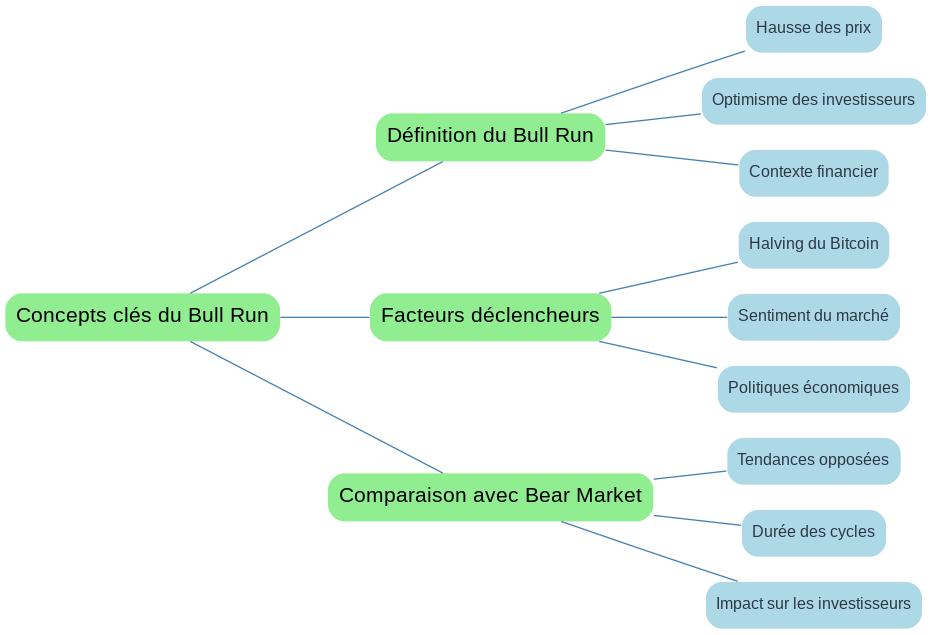

Introduction to Bull Run

The term bull run is often used to describe a prolonged period of rising prices in financial markets, particularly in the cryptocurrency sector. These periods are marked by widespread optimism among investors, who anticipate future gains. In the context of cryptocurrency, bull run is often associated with specific events like the bitcoin halving, which reduces the supply of new coins and can stimulate prices. Understanding this phenomenon is crucial for investors seeking to maximize their profits and navigate effectively in market cycles.

Definition of Bull Run

A bull run is characterized by a sustained rise in asset prices, often fuelled by positive investor sentiment. What triggers a bull run? Factors include economic improvements, technological innovations or favourable regulatory changes. In the cryptocurrency world, events like the bitcoin halving can play a crucial role in reducing supply and increasing demand.

Importance in financial markets and cryptocurrency

Bull runs are crucial times for investors because they offer significant opportunities for profit. Why are investors interested in bull runs? These periods allow for quick gains, but they also require a well-planned entry and exit strategy to avoid losses during market reversals. In the cryptocurrency sector, bull runs can be particularly volatile, but also very lucrative.

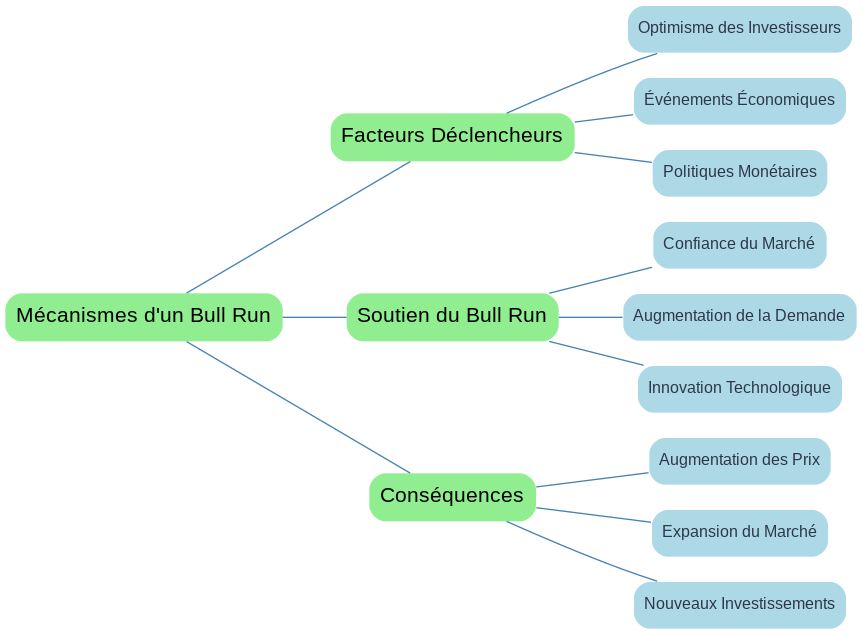

Mechanisms of a Bull Run

A bull run is a period characterized by a sustained rise in the prices of financial assets, often fuelled by widespread investor optimism. But what really triggers a bull run and how does it keep up? This section explores the various factors that can initiate and support a bull run, emphasizing the importance of investor optimism and key economic events. Bull runs are often associated with periods of economic growth, accommodative monetary policies, and technological innovations that stimulate market confidence and attract new investment.

Factors Trigger

The triggers of a bull run generally include investor optimism, which can be fuelled by positive economic news or technological innovations. Accommodative monetary policies, such as lower interest rates, can also play a crucial role in making credit cheaper and encouraging investment.

Bull Run support

Once a bull run is in progress, several factors can help maintain it. Continued investor confidence, increased demand for assets, and technological innovations that promise new growth opportunities are essential. These elements create a virtuous circle where price increases attract more investment, thus strengthening bull run.

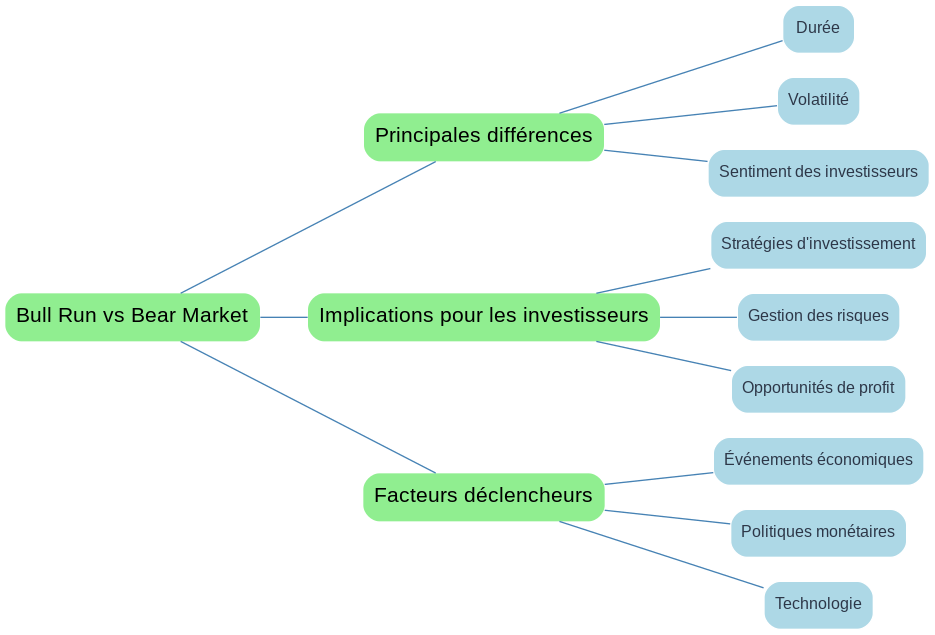

Bull Run vs Bear Market

In the financial world, understanding the difference between a bull run and a bear market is crucial for investors. A bull run is characterized by a prolonged period of rising asset prices, often fuelled by investor optimism and favourable economic conditions. On the other hand, a bear market is marked by a prolonged decline in prices, usually accompanied by pessimism and unfavourable economic conditions. These two market phases have significant implications for investment strategies and risk management.

Main differences between Bull Run and Bear Market

Bull runs and bear markets differ mainly in price direction and duration. A bull run is a period of continuous price increases, often supported by positive investor sentiment and favourable economic indicators. However, a bear market is a period of prolonged price decline, often accompanied by pessimism and difficult economic conditions. Volatility is generally higher in a bear market, which can create opportunities but also increased risks for investors.

Implications for investors

The implications of a bull run and a bear market for investors are profound. During a bull run, investors can benefit from significant gains, but they must also be aware of the risks of overvaluation of assets. In a bear market, investment strategies must focus on the preservation of capital and the search for cheap buying opportunities. Risk management becomes crucial to avoid significant losses.

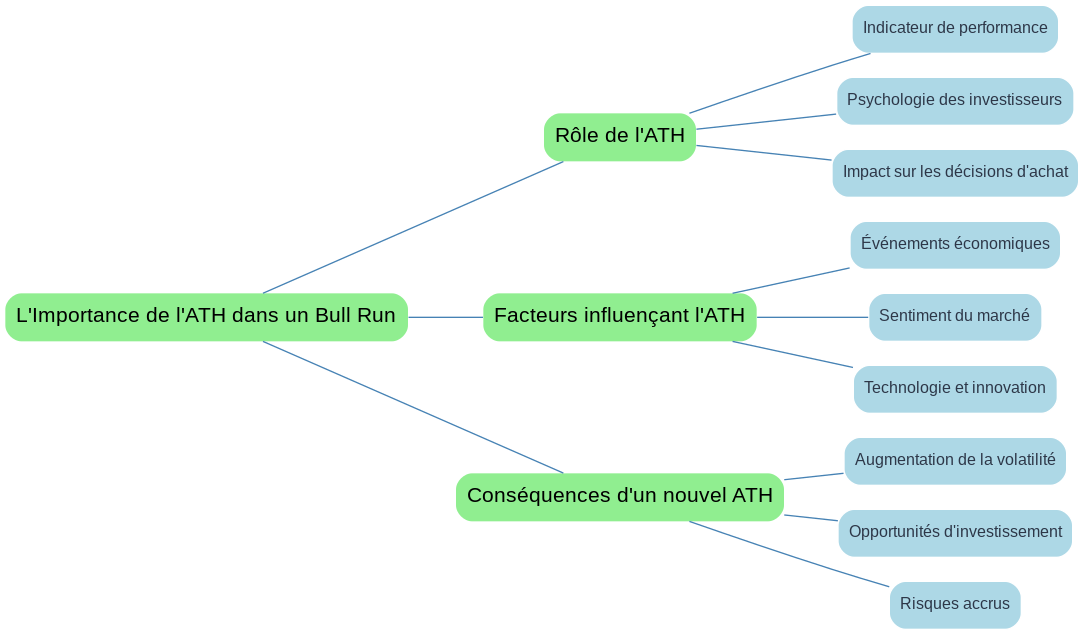

The Importance of ATH in a Bull Run

In the world of financial markets, the ATH, or « All Time High », represents the highest price ever reached by an asset. ATH is crucial in a bull run because it symbolizes a new performance summit for an asset, attracting the attention of investors and the media. When an asset reaches a new ATH, it can trigger a wave of optimism and confidence among investors, often followed by an increase in transaction volumes. This dynamic can strengthen the bull run, creating a virtuous circle where higher prices attract more investors, further driving up prices. However, it is important to note that the achievement of an ATH can also signal an overheating of the market, prompting some investors to take profits, which may result in temporary corrections.

Role of ATH in Investor Psychology

ATH plays a major psychological role in investment decisions. When an asset reaches a new ATH, it can be seen as a sign of strength and future potential, encouraging investors to buy more. Why does ATH influence purchasing decisions so much? This is mainly because it is often interpreted as an indicator of market confidence. Investors can see this as a validation of their investment choices, which reinforces their commitment and willingness to take additional risks.

Consequences of a New ATH on the Market

Reaching a new ATH can have several consequences on the market. On the one hand, it can attract new investors, thereby increasing liquidity and volatility. On the other hand, this may also signal a potential turning point, where investors start taking profits, resulting in price corrections. What are the risks associated with a new ATH? Risks include increased volatility and the possibility of a speculative bubble, where prices are pushed beyond their intrinsic value.

Conclusion

In this article, we explored the definition of bull run and its crucial importance to investors. Understanding the mechanisms of a bull run helps to anticipate market movements and make informed decisions. Bull runs, often triggered by widespread optimism and key economic events, can offer significant gains opportunities for those who know how to identify and exploit them.

We also compared bull runs to bear markets, highlighting the essential differences between these two market phases. While bull runs are marked by higher prices and positive sentiment, bear markets are characterized by lower prices and pessimism.

The importance of the All Time High (ATH) was discussed, illustrating how these historic summits influence investment decisions and market psychology. Reaching an ATH can build investor confidence and attract new capital, fuelling the bull cycle.

In conclusion, understanding bull runs is essential for any investor wishing to navigate effectively in financial markets and cryptocurrency. By staying informed and analysing trends, investors can better position themselves to take advantage of the opportunities offered by these growth periods.

Summary of Key Points

This subsection summarizes the main aspects of the article, such as the definition of bull run, triggering factors, and the importance of ATH. It highlights the importance of this knowledge to investors.

Future outlook

Here we discuss the future implications of bull runs on financial markets, stressing the importance of keeping informed and prepared for future investment opportunities.

FAQ

What is a Bull Run?

What is a Bull Run?

A Bull Run is a period when the prices of financial assets, such as shares or cryptocurrency, increase significantly and steadily. This is often fuelled by the optimism of investors and positive economic factors.

What’s a bull?

What’s a bull?

In the financial context, a ‘bull’ is an investor who believes that the market or a particular asset will increase in value. The ‘bulls’ are optimistic about rising prices.

What’s ATH?

What’s ATH?

ATH means ‘All Time High’, which is the highest price ever achieved by a financial asset. Reaching an ATH is often an indicator of strong market performance.

What’s Halving?

What’s Halving?

Halving is an event in the world of cryptocurrency, notably Bitcoin, where the reward for mining new blocks is divided by two. This reduces the supply of new parts and can influence the price.

What’s a bear market Crypto?

What’s a bear market Crypto?

A crypto bear market is a prolonged period of decline in cryptocurrency prices. This is characterized by negative investor sentiment and a general trend towards sales.

Bull run crypto what is it?

Bull run crypto what is it?

A crypto bull run is a time when cryptocurrency prices are rising rapidly and steadily, often due to market optimism and the growing adoption of cryptocurrency.