| Factor | Impact on Bitcoin |

|---|---|

| Increase in interest rates | Reduction of short-term investment |

| Lower interest rates | Increased investment in risky assets |

| High inflation | Incentive to invest in alternative assets |

Impact of Fed Decisions on the Bitcoin Market

In this analysis, we will explore the potential impact of Federal Reserve (Fed) decisions on the Bitcoin market, a crucial topic for investors and cryptocurrency enthusiasts. Fed interest rates are a key indicator which influences not only the cryptocurrency market but also the global economy. Julien Roman, an expert in cryptography and analysis, guides us through the short- and long-term implications of these major economic decisions.

Short Term Impact of Fed Decisions

The Fed’s decisions, including interest rate revision, can have immediate impacts on the Bitcoin market. As Julien Roman points out, an increase in interest rates is often a response to rising inflation. This can reduce short-term investment, as investors seek to minimize risks. However, a drop in rates, such as the one anticipated at 0.25 basis points, could encourage investments in more risky assets like Bitcoin, thus providing a rebound opportunity for the cryptocurrency market.

Long Term Impacts and Investment Strategies

In the long term, interest rate adjustments by the Fed can influence the investment strategy of market participants. A downward trend in rates could signal a period of growth for Bitcoin, as investors seek to protect themselves from inflation by turning to alternative assets. How can investors prepare for these changes? By diversifying their portfolios to include assets such as real estate, stocks, and of course cryptocurrency, to maximize returns while minimizing risks.

Influence on Bitcoin ————————————— • Increase in interest rates • Lower interest rates High Inflation: Incentive to invest in alternative assets:

Short Term Impact of Fed Decisions

The Fed’s decisions, including interest rate revision, can have immediate impacts on the Bitcoin market. As Julien Roman points out, an increase in interest rates is often a response to rising inflation. This can reduce short-term investment, as investors seek to minimize risks. However, a drop in rates, such as the one anticipated at 0.25 basis points, could encourage investments in more risky assets like Bitcoin, thus providing a rebound opportunity for the cryptocurrency market.

Long Term Impacts and Investment Strategies

In the long term, interest rate adjustments by the Fed can influence the investment strategy of market participants. A downward trend in rates could signal a period of growth for Bitcoin, as investors seek to protect themselves from inflation by turning to alternative assets. How can investors prepare for these changes? By diversifying their portfolios to include assets such as real estate, stocks, and of course cryptocurrency, to maximize returns while minimizing risks.

| Factor | Impact on Bitcoin |

|---|---|

| Increase in interest rates | Reduction of short-term investment |

| Lower interest rates | Increased investment in risky assets |

| High inflation | Incentive to invest in alternative assets |

The Impact of Fed Rates on the Cryptocurrency Market

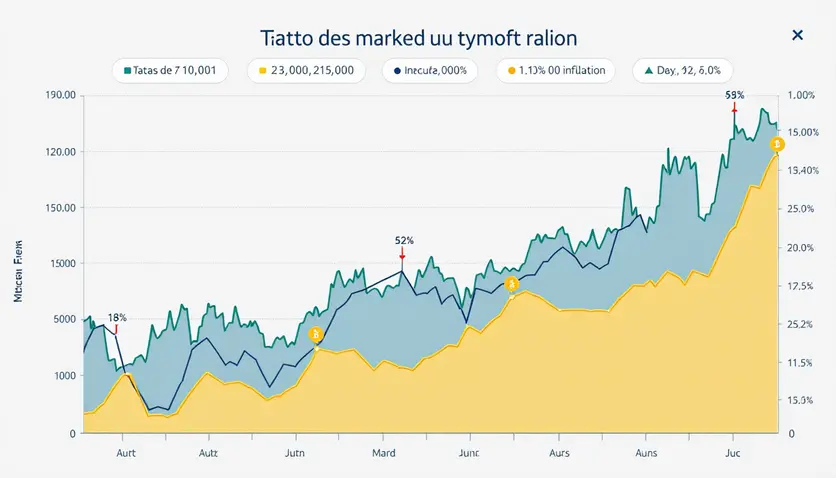

The cryptocurrency market, especially Bitcoin, has demonstrated exceptional performance over the last fifteen years, surpassing all other asset classes. This overperformance is partly due to the increasing acceptance of cryptocurrency by financial institutions, as evidenced by the introduction of Bitcoin and Ether ETFs. However, a key factor influencing this market is the monetary policy of the US Federal Reserve (Fed), including its interest rates.

Fed rates have a direct impact on inflation, which is a crucial indicator for investors. Currently, inflation is rising to 3.05 per cent, after falling from 11 per cent to 2 per cent. This fluctuation prompted the Fed to adjust its rates to maintain inflation at a target level of 2%. The crucial question is: how do these adjustments affect the cryptocurrency market?

Historically, a decline in Fed rates has often coincided with an increase in cryptocurrency prices. For example, in the bull cycle from 2020 to 2022, rates were relatively low, resulting in an influx of cash into the crypto market. However, when rates began to rise, the market slowed down. This correlation underlines the importance of macroeconomic conditions in the evolution of cryptocurrency.

Influence of Fed Rates on Inflation

The Fed’s interest rates play a crucial role in managing inflation. Currently, inflation is up to 3.05 per cent, after a significant decline. This has led the Fed to adjust its rates to stabilize the economy. How do these adjustments affect the cryptocurrency market? Historically, a decline in rates has often coincided with an increase in crypto prices, as investors seek higher returns in more risky assets.

Future Projections for Bitcoin

According to projections, if the money supply continues to increase, Bitcoin could reach $132,000 by 2025. This forecast is based on an 18% increase in overall liquidity (M2). However, these projections are highly dependent on the Fed’s future monetary policies and inflation trends.

| Factor | Impact on the Cryptos Market |

|---|---|

| Fed rate | Direct influence on inflation and crypto investment |

| Inflation | Fluctuations influence investor confidence |

| Liquidity Projections | Potential Bitcoin Price Increase |

Impact of Fed Announcements on the Bitcoin Market

Recent Federal Reserve (Fed) announcements have a significant impact on the Bitcoin market, influencing short-term trends and investment decisions. Jérôme Powell, President of the Fed, recently indicated that inflation could reach 3.4% by 2025, which is close to the Fed’s target. Although inflation has increased slightly in the last six months, these forecasts are crucial for Bitcoin investors.

With each announcement by the Federal Open Market Committee, there is an immediate market reaction. For example, the Fed’s interest rate decreases have often been followed by an increase in the price of Bitcoin. This happened during the periods of September and November, where each ad resulted in a significant increase in Bitcoin. Why are these ads so influential? Because they alter investors’ expectations of future monetary policy, which directly affects the perception of Bitcoin value.

In addition, the market is currently in Bull Run phase, which means that even minor corrections can be seen as buying opportunities. The Fear and Greed Index, which measures market sentiment, indicates an « extreme gourmandise » at 80, but not yet at the critical level of 90 or more, often reached at the end of the bull cycle. Trade financing rates, which are currently low, are also an indicator to be monitored to anticipate the end of Bull Run.

Market Reactions to Fed Announcements

The Fed’s announcements, including interest rates, have an immediate impact on the Bitcoin market. Each rate drop was followed by an increase in Bitcoin price, illustrating market sensitivity to monetary policies. How do these ads influence the market? They change investor expectations, thus influencing buying and selling decisions.

Key Indicators to Monitor

Among the indicators to be monitored are the Fear and Greed Index and trade financing rates. Currently, the market shows « extreme gourmandise », but not yet at the critical level. Low funding rates suggest that the Bull Run could continue, but a sudden increase could signal an imminent end.

| Indicator | Current value | Interpretation |

|---|---|---|

| Inflation Planned | 3.4% by 2025 | Close to Fed’s objective |

| Fear and Greed Index | 80 | Extreme gourmet, but not critical |

| Rate of funding | 0.02 | Down, suggesting a continuation of Bull Run |

FAQ

How do Fed decisions affect the short-term Bitcoin market?

How do Fed decisions affect the short-term Bitcoin market?

Fed’s decisions, including interest rate adjustments, can have an immediate impact on the Bitcoin market. An increase in interest rates tends to reduce short-term investments, as investors seek to minimize risks. Conversely, lower rates can encourage investments in more risky assets such as Bitcoin, thus providing a rebound opportunity for the cryptocurrency market.

What is the impact of Fed interest rates on long-term bitcoin?

What is the impact of Fed interest rates on long-term bitcoin?

In the long term, a downward trend in interest rates by the Fed can signal a period of growth for Bitcoin. Investors seek to protect themselves from inflation by turning to alternative assets, which may include Bitcoin. This influences the investment strategy of market participants, who can diversify their portfolios to include cryptocurrency.

Why are Fed ads important to the Bitcoin market?

Why are Fed ads important to the Bitcoin market?

The Fed’s announcements, including interest rates, change investors’ expectations of future monetary policy. This directly affects the perception of Bitcoin value and influences buying and selling decisions. For example, interest rate decreases have often been followed by an increase in the price of Bitcoin.

What indicators monitor to anticipate Bitcoin market movements?

What indicators monitor to anticipate Bitcoin market movements?

Key indicators to monitor include the Fear and Greed Index and trade financing rates. The Fear and Greed Index measures market sentiment, and a high value indicates « extreme gourmandise ». Low funding rates suggest that the Bull Run could continue, but a sudden increase could signal an imminent end.

How can investors prepare for Fed monetary policy changes?

How can investors prepare for Fed monetary policy changes?

Investors can prepare for Fed monetary policy changes by diversifying their portfolios. This includes adding assets such as real estate, shares, and cryptocurrency, to maximize returns while minimizing risks. Diversification helps to better manage the impacts of interest rate and inflation fluctuations.